OOPS! You forgot to upload swfobject.js ! You must upload this file for your form to work.

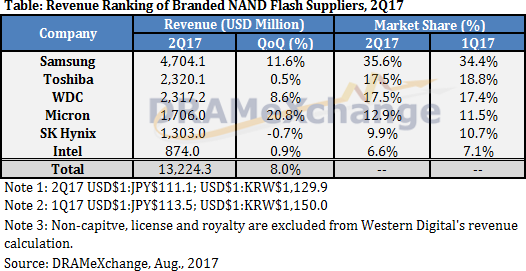

Prices for solid-state memory will grow in the third quarter

![]()

|

xtreview is your : Video card - cpu - memory - Hard drive - power supply unit source |

|

|||

|

|

||||

Recommended : Free unlimited image hosting with image editor

Recommended : Free unlimited image hosting with image editor

|

xtreview is your : Video card - cpu - memory - Hard drive - power supply unit source |

|

|

|

|

||

|

Xtreview Support  N-Post:xxxx Xtreview Support        |

PRICES FOR SOLID-STATE MEMORY WILL GROW IN THE THIRD QUARTER |

| Please Feel Free to write any Comment; Thanks  |

Japanese sellers have lowered prices for Radeon RX Vega 64 (2017-09-04)

hype around the prices for Radeon RX Vega helps only competitors (2017-08-30)

A new round of video card price hike is triggered by a rise in prices for memory chips (2017-08-28)

Prices for solid-state memory will grow in the third quarter (2017-08-24)

Japanese shops rushed to reduce prices for AMD processors Ryzen Threadripper (2017-08-24)

With the memory of SK Hynix new hopes for the normalization of prices for Radeon RX Vega 64 (2017-08-24)

AMD promises to do everything possible to return prices for Radeon RX Vega to the recommended level (2017-08-23)

Prospective prices and frequencies AMD Radeon RX Vega (2017-07-31)

Review of AMD Ryzen 3 processors raised the question of prices relevance (2017-07-20)

In this quarter, prices for memory will grow by another 4-6 percents (2017-07-19)

Intel Skylake-SP: all prices are in one list (2017-07-12)

Incident at the Micron factory can contribute to a further rise in prices for memory (2017-07-06)

Intel markedly lowered prices for Xeon Phi accelerators (2017-06-20)

AMD once again declares that it did not reduce prices for Ryzen processors (2017-06-10)

AMD holds stable prices for Ryzen processors (2017-06-07)

There is no Official drop in prices for AMD Ryzen processors (2017-06-02)

Gartner expects lower prices for memory only by 2019 (2017-04-17)

In the second quarter, wholesale prices for memory for PCs will grow by no less than 12.5 percents (2017-04-16)

The trend towards an increase in prices for SSD may persist until the end of the year (2017-04-06)

Due to higher prices for memory, the forecast for the semiconductor market improved (2017-03-31)

![]()

To figure out your best laptops .Welcome to XTreview.com. Here u can find a complete computer hardware guide and laptop rating .More than 500 reviews of modern PC to understand the basic architecture

7600gt review

7600gt is the middle card range.

We already benchmarked this video card and found that ...

geforce 8800gtx and 8800gts

geforce 8800gtx and 8800gts  Xtreview software download Section

Xtreview software download Section  AMD TURION 64 X2 REVIEW

AMD TURION 64 X2 REVIEW  INTEL PENTIUM D 920 , INTEL PENTIUM D 930

INTEL PENTIUM D 920 , INTEL PENTIUM D 930  6800XT REVIEW

6800XT REVIEW  computer hardware REVIEW

computer hardware REVIEW  INTEL CONROE CORE DUO 2 REVIEW VS AMD AM2

INTEL CONROE CORE DUO 2 REVIEW VS AMD AM2  INTEL PENTIUM D 805 INTEL D805

INTEL PENTIUM D 805 INTEL D805  Free desktop wallpaper

Free desktop wallpaper  online fighting game

online fighting game  Xtreview price comparison center

Xtreview price comparison center Lastest 15 Reviews

Rss Feeds

Last News

- The new version of GPU-Z finally kills the belief in the miracle of Vega transformation

- The motherboard manufacturer confirms the characteristics of the processors Coffee Lake

- We are looking for copper coolers on NVIDIA Volta computing accelerators

- Unofficially about Intels plans to release 300-series chipset

- The Japanese representation of AMD offered monetary compensation to the first buyers of Ryzen Threadripper

- This year will not be released more than 45 million motherboards

- TSMC denies the presentation of charges from the antimonopoly authorities

- Radeon RX Vega 64 at frequencies 1802-1000 MHz updated the record GPUPI 1B

- AMD itself would like to believe that mobile processors Ryzen have already been released

- AMD Vega 20 will find application in accelerating computations

- Pre-orders for new iPhone start next week

- Radeon RX Vega 57, 58 and 59: the wonders of transformation

- ASML starts commercial delivery of EUV-scanners

- The older Skylake processors with a free multiplier are removed from production

- Meizu will release Android-smartphone based on Helio P40

- AMD Bristol Ridge processors are also available in American retail

- The fate of Toshiba Memory can be solved to the next environment

- duo GeForce GTX 1080 Ti in GPUPI 1B at frequencies of 2480-10320 MHz

- New Kentsfield overclocking record up to 5204 MHz

- Lenovo released Android-smartphone K8

HALO 3 HALO 3 - Final Fight!

PREY Prey is something you don t often see anymore: a totally unigue shooter experience.

computer news computer parts review Old Forum Downloads New Forum Login Join Articles terms Hardware blog Sitemap Get Freebies